by BTG | Jul 1, 2016 | Uncategorized

Creating Value in Your Business to Get Top Dollar When You Leave It

Did you ever wonder why one business has buyers lined up willing to pay top dollar while another sits on the market for months, or even years? What do buyers look for in a prospective business acquisition?

There are many opinions about what attributes or characteristics buyers seek, but here’s what we know: the characteristics buyers seek must exist before the sale process even begins and it is your job as the owner to create value within your business prior to the sale. We call characteristics that impact value “Value Drivers.”

Walk a Mile in a Buyer’s Shoes

To get an idea of the importance of Value Drivers when preparing to sell your business, it is important to put on the buyer’s shoes for a minute. Let’s look at a hypothetical case study that illustrates how a buyer might compare two similar companies with a different emphasis on Value Drivers.

The A Factor Company has EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) of $2 million, an owner who runs the business and the systems and processes that create growth. The A Factor Company doesn’t have a real management team in place and the owner generates a majority of its sales. The owner is the center point of the company, holding both the CEO and CFO positions. With this level of responsibility, the owner is burning out quickly.

In comparison, The B Factor Company also has EBITDA of $2 million and a solid management team that runs the business, systems and processes. The management team creates efficiencies within the business and the owner vacations for six weeks a year.

If you were a buyer comparing these two companies, which would provide a more attractive business opportunity? How much more would you pay for a business with a strong management team (one of the most important Value Drivers)? Would you even be interested in buying a business whose management team (the owner) walks out when you walk in?

Investment bankers understand that companies that lack strong Value Drivers also lack a bevy of buyers. Those buyers that do come to the table do not arrive with pockets full of cash.

Let’s look at several of the more important Value Drivers common to all industries:

- A stable and motivated management team. If you can wait a year to sell your business, we suggest that you consider an incentive compensation system, cash or stock-based, that rewards key employees as the company performs (usually measured by increases in pre-tax income). Sophisticated buyers know that with a solid management team in place, prospects are good for continued business success. Without a strong management team, it may be very difficult to sell your business to a third party or transfer it to an insider.

- Operating systems that improve sustainability of cash flows. Operating systems include the computerized and manual procedures used in the business to generate its revenue and control expenses, (i.e. create cash flow), as well as the methods used to track how customers are identified and how products or services are delivered. The establishment and documentation of standard business procedures and systems demonstrate to a buyer that the business can be maintained profitably after the sale.

- A solid, diversified customer base. Buyers typically look for a customer base in which no single client accounts for more than 10 percent of total sales. A diversified customer base helps insulate a company from the loss of any single customer. If the majority of your customer base is made up of only one or two good customers, consider reinvesting your profits into additional capacity that will make developing a broader customer base possible.

- A realistic growth strategy. Buyers tend to pay premium prices for companies with realistic strategies for growth. Even if you expect to retire tomorrow, it makes sense to have a written plan describing future growth and how that growth will be achieved based on industry dynamics, increased demand for the company’s products, new product lines, market plans, growth through acquisition, and expansion through augmenting territory, product lines, manufacturing capacity, etc. It is this detailed growth plan, properly communicated, that helps to attract buyers.

- Effective financial controls. Financial controls are not only a critical element of business management, but they also safeguard a company’s assets. Effective financial controls support the claim that a company is consistently profitable. The best way to document that your company has effective financial controls and that its historical financial statements are correct is through a certified audit or perhaps a verified financial statement by an established CPA firm.

- Stable and improving cash flow. Ultimately, all Value Drivers contribute to stable and predictable cash flow. It is important, especially in the year or so preceding the sale of the business, that cash flow be substantial and on an upswing. You can begin increasing cash flow today by simply focusing on ways to operate your business more efficiently by increasing productivity and decreasing costs.

You can install these Value Drivers and better position your company to secure a premium price upon your exit with the help of a trained Exit Planning Advisor.

In future articles, we will look at the most common Value Drivers in more detail.

If you have any questions about increasing the value of your business prior to your exit, please contact us to discuss your particular situation. We can help you identify and strengthen the current Value Drivers in your business, install additional Value Drivers, and create a road map to meet your overall exit objectives. We also have additional resources that explain Value Drivers in more detail and help you apply these concepts to your business.

The information contained in this article is general in nature and is not legal, tax or financial advice. For information regarding your particular situation, contact an attorney or a tax or financial advisor. The information in this newsletter is provided with the understanding that it does not render legal, accounting, tax or financial advice. In specific cases, clients should consult their legal, accounting, tax or financial advisor. This article is not intended to give advice or to represent our firm as being qualified to give advice in all areas of professional services. Exit Planning is a discipline that typically requires the collaboration of multiple professional advisors. To the extent that our firm does not have the expertise required on a particular matter, we will always work closely with you to help you gain access to the resources and professional advice that you need.

The example provided is hypothetical and for illustrative purposes only. It includes fictitious names and does not represent any particular person or entity.

Copyright © 2016 Business Enterprise Institute, Inc., All rights reserved.

by BTG | Jul 1, 2016 | Uncategorized

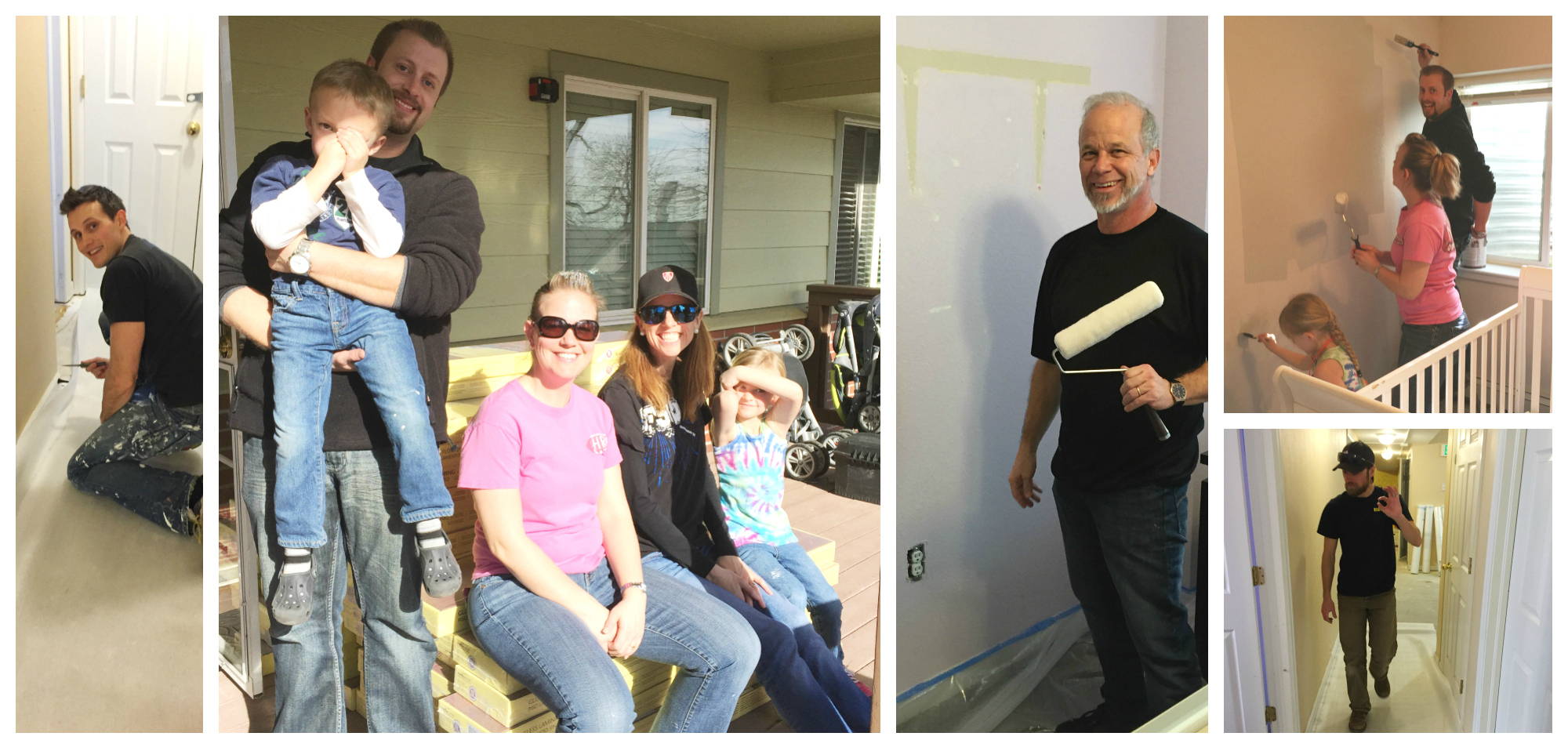

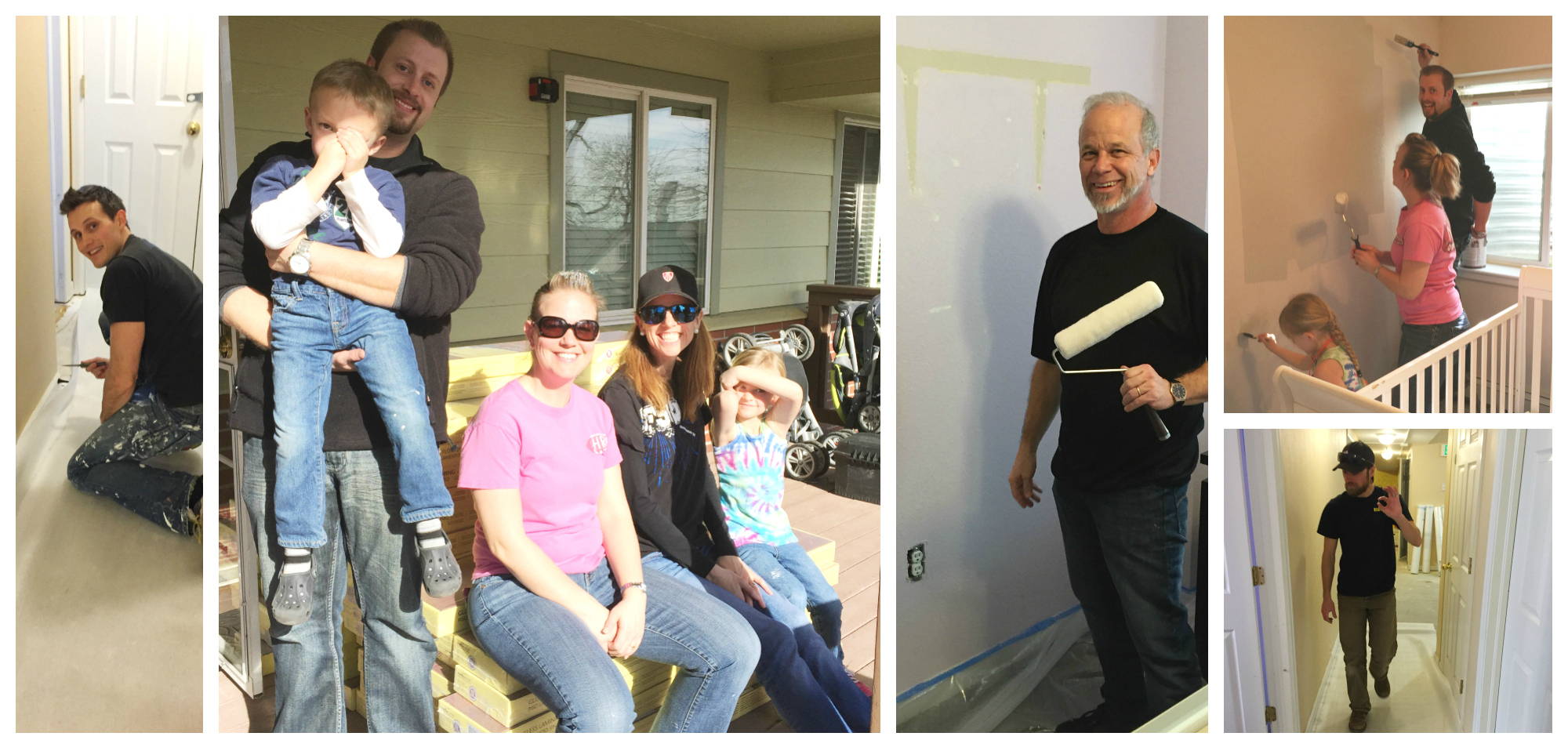

Last Saturday the BTG team volunteered at Hope House, a home for teen mothers and their children. We washed cars, painted walls, removed old carpet and installed new flooring. It was truly a great experience to not only give back to our community, but a unique way to bond outside the office. This service day was made possible by an organization that we support and hold in the highest regard, The Lion Project.

by BTG | Jul 1, 2016 | Uncategorized

L to R: April Obholz Bergeler, Chris Rhyme, Whitney Rhyme, Bob Rhyme, Daniel Newman, Katy Jones

by BTG | Jul 1, 2016 | Uncategorized

These five steps make it more likely that the entrepreneurial fire will stay burning.

The Wirsching family, whose current members include Lena, Sebastian, Andrea, Victoria and Heinrich (above), has been producing wine since the 1630s.

PHOTO: INA BROSCH

By PETER JASKIEWICZ and JAMES G. COMBS

Updated Nov. 20, 2015 2:01 p.m. ET

Here’s a sobering fact for entrepreneurs passionate about their business creations: Most family-owned businesses lose that creative spark in subsequent generations.

The reason is that the personality traits that spur a founder to create something unique—passion, hunger, obsession and others—disappear over the years. The company either crumbles quickly or lingers on as growth sputters and the family lives off wealth accumulated by previous generations. Often, they end up pouring more and more money into the failing enterprise or treat running the business as a lifestyle choice rather than a way to bring in money.

But it’s not impossible for family businesses to keep the entrepreneurial fire burning. Some companies not only last a long time, but keep growing and evolving.

What’s their secret?

We decided to investigate that question, along with our colleague Sabine Rau from King’s College in London. We studied 21 family-owned wineries in Germany that were ready to make a generational transition. The average winery was founded 11 generations ago in the 18th century, and the oldest started passing the torch 33 generations ago in the 10th.

We interviewed the current generation’s leaders and their children, who were in the process of taking over. About half claimed to have maintained a spirit of entrepreneurship and innovation across generations, being among the first in their industry to take steps such as growing new grape varieties, introducing new products and adopting the latest production technologies.

We called the other half of the wineries “traditional.” They were stable or growing slowly, but they never claimed to be particularly entrepreneurial, and the current generation followed rather than led, only adopting new technology or entering new markets after competitors paved the way.

Our conclusion? Five factors distinguish the very entrepreneurial families from the ones that were following a well-trodden path.

- They pass along family history. The innovative families have what we call an “Entrepreneurial Legacy” that is passed from each generation to the next: a narrative about the family’s achievements and how it survived tough times, such as the great-great-great-great-uncle who rode his horse to Paris to repurchase the family winery at auction after it was seized by Napoleon. Stories of how the family overcame theft, natural disasters, economic hardship and war are told repeatedly at the dinner table and family gatherings. They give meaning to today’s entrepreneurial actions and put current risks and problems in a broader context. It is hard to complain about losing a customer knowing your great-grandparents overcame war and starvation to build the business. In contrast, both generations in the less entrepreneurial “traditional” wineries either lacked knowledge about their history or played it down as a product of chance. They lacked pride in their ancestors’ achievements.

- They get the youngsters started early. Entrepreneurial families immerse their children in the business from an early age. From planting and pruning vines to packing and shipping bottles, the children—and members of the extended family—are involved. These families actively resist the view that childhood is foremost a time to play and explore. Children in the traditional wineries, on the other hand, didn’t make their children work regularly in the family business, and some parents even considered it harmful. As a result, the children didn’t develop the same kind of emotional attachment to the business.

- They insist on practical education. Both entrepreneurial and traditional families encourage secondary education. But while the traditional parents encouraged their children to find their own paths, entrepreneurial parents endorsed attending the best colleges in the world and encouraged studying topics that are relevant to winemaking, such as business and law. After college, before joining the family business, most children from entrepreneurial families went to work for competitors or in other wine-related businesses around the world. Both groups came home well educated, but only the entrepreneurial children were also multilingual global citizens, poised to grow the family business. For children from traditional firms, taking over was “an obligation” and a “family tradition,” but not an “entrepreneurial passion.”

- They learn from the younger generation. As a result of embracing the family’s entrepreneurial legacy, childhood immersion in the business and a strategically focused world-class education, entrepreneurial families enjoy “entrepreneurial leaps” when a child comes home and re-enters the business. Traditional family firms use a “relay” succession, where the parent and child work together so the child can learn the business. In entrepreneurial families, though, the child is the teacher. The parents run day-to-day operations while the children use what they learned outside the family firm to develop new product lines, enter new markets and adopt the latest winemaking technology.

- They have one owner. Period. Finally, entrepreneurial families protect their businesses from being sold or split by giving ownership to one child. The successor inherits a social obligation to take care of his or her siblings, but the philosophy is that the family is better off with a successful winery that benefits everyone, even if it means that the children receive unequal inheritances.

Also, because all siblings grew up the same way and were offered the same educational advantages, even those who don’t take over the family business still benefit from their entrepreneurial legacy.

In fact, siblings in entrepreneurial families regularly pursued educational paths similar to the designated successor. Although the siblings weren’t given the family business, they were given financial and emotional support for their own entrepreneurial ventures, most of which were in the same or in related areas, such as wine stores, restaurants and hotels.

A related step is that entrepreneurial families actively integrate future in-laws into the family by including them in family retreats and shared holidays. A few even hired consultants to help them improve family communications. Good relations with in-laws help cultivate the next generation of entrepreneurs, while poor relations often fuel the demise of entrepreneurial families.

Can the same strategies work in the U.S.? A number of trends may make it difficult. Families are getting smaller, as well as less cohesive and less stable—which means fewer potential successors and a tougher transition from one generation of ownership to the next. Childhood is also increasingly viewed as a time for play and innocence, not a time to work. And the idea of giving one child more than another strikes many parents as unfair.

Still, families can share stories, and the evidence we found suggests that telling and retelling tales about the family’s entrepreneurial legacy inspires children toward entrepreneurship, both inside and outside the family firm. If there is an entrepreneur in your family, tell his or her story. It might become the steppingstone toward an entrepreneurial legacy that lasts for generations.

Dr. Jaskiewicz is CIBC distinguished professor in entrepreneurship and family business at Concordia University’s John Molson School of Business. Dr. Combs is Dr. Phillips Chair of American Private Enterprise at the University of Central Florida. They can be reached at reports@wsj.com.

by BTG | Jul 1, 2016 | Sponsorships

We are honored to be in a meaningful partnership with The Lion Project, a Denver-based organization that meets the tangible needs of local non-profits, and in turn, brings real change within their communities. With the help of our loyal clients, we are able to take a portion of our revenue and give to those with significant needs. Our hope is that many lives will be impacted.

Below is a link to our sponsored video featuring Joshua Station, a faith-based community that transitions families from homelessness to a stable living environment. Please enjoy watching the transformation of their children’s play area!

Video: The Lion Project Joshua Station